When it comes to the Federal Reserve, its policies wield substantial influence over consumer prices and interest rates. The choices they make today directly and profoundly impact our market, economy, and even our retirement tomorrow.

Retiring wealthy is a financial goal for many Iowans. This endeavor entails disciplined savings, smart investments, and well-informed choices aimed at helping secure your financial future. Yet, many factors can significantly influence your retirement plans. One underestimated aspect is the role of the FED.

In this blog, we will explore the nature of the FED, how its rates can affect your retirement, and how a Fiduciary can help you navigate these intricate financial waters. Here’s what you need to know.

Understanding the Federal Reserve (FED)

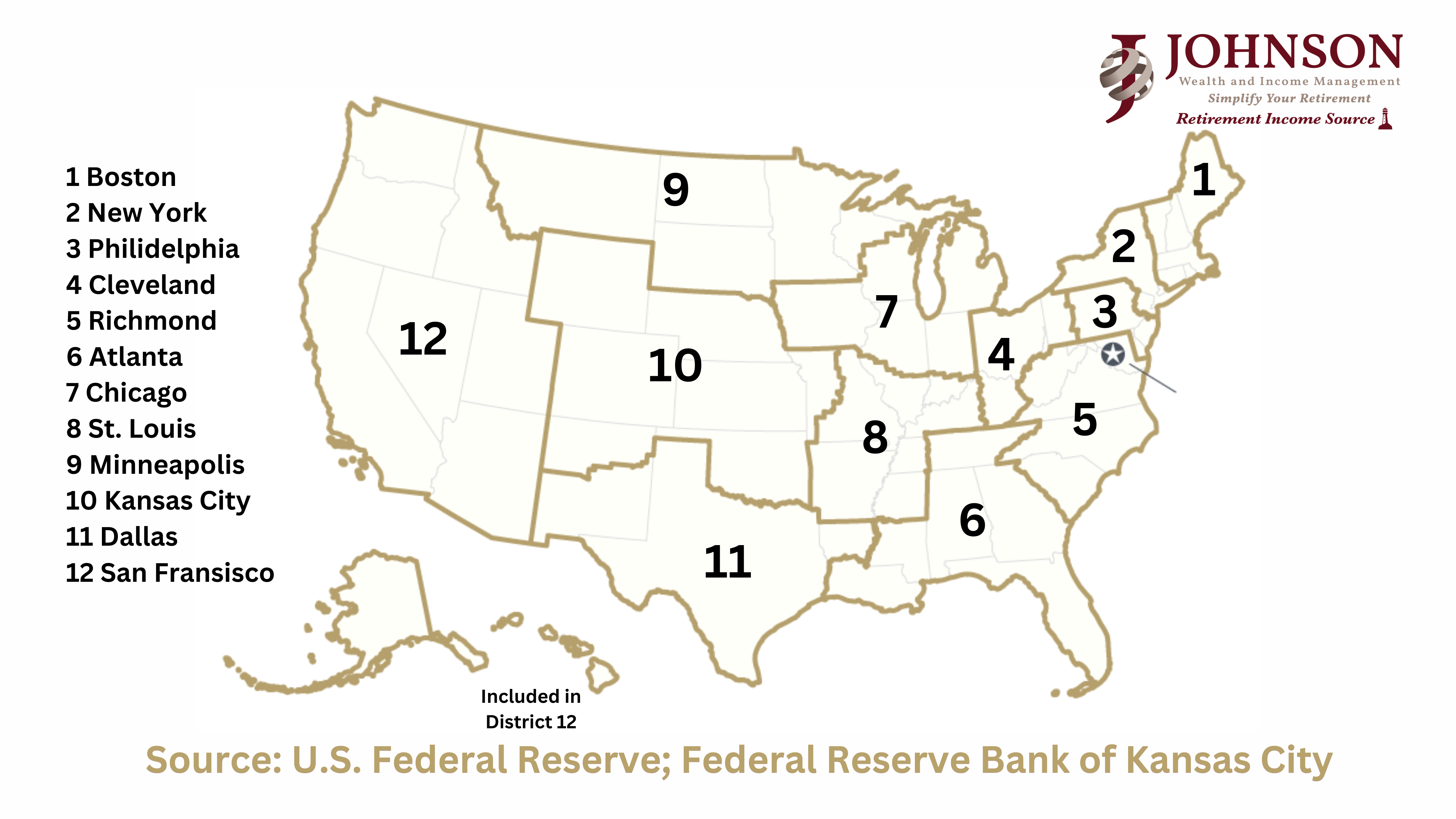

The Federal Reserve, often called the FED, is like the financial captain of the United States. It was created in 1913 by the Federal Reserve Act and consists of twelve regional banks comprising government and private entities. The FED has three main jobs: managing the country’s money policies, keeping an eye on big banks, and helping to ensure the financial system doesn’t go haywire.

In the past, the FED had two main goals. First, it wanted to keep prices steady, which usually meant aiming for a 2% price increase each year. Second, it wanted to make sure as many people as possible had jobs, which meant keeping unemployment low, typically around 4-5%.

The FED can buy or sell U.S. Treasury bonds in the open market. When the FED buys bonds, it pumps more money into the financial system, making borrowing more affordable. They can also lend money to banks to increase the amount of money in circulation. These strategies can help benefit retirees preserve the value of their assets, potentially reducing the risk of market downturns that could erode their wealth.

Now that we know how the FED works let’s dive into how it can affect your purchasing power.

How FED Rates Affect Your Purchasing Power

You’ve probably heard the saying, “You can’t fight the FED,” but what does it mean? It means the Federal Reserve (FED) greatly impacts our money and what we can buy. The Federal Reserve’s decisions regarding interest rates extend beyond borrowing and saving costs; they hold sway over the broader economy.

These decisions ripple through various aspects of our financial lives, ultimately impacting our purchasing power as consumers. Currently, the interest rate sits at 3.70%. When interest rates change, they can influence the rates on loans, savings, and even the performance of investments.

These shifts can significantly affect how much we can spend and save. By managing inflation and supporting overall economic stability, the FED indirectly helps to enhance the purchasing power of retirees, helping to allow them to maintain their desired standard of living and make meaningful financial choices throughout their retirement years.

So, the Fed’s interest rate decisions are not just numbers on a screen; they are fundamental drivers of our ability to make financial choices and maintain our desired standard of living.

How FED Rates Affect Your Retirement

You might wonder why the Federal Reserve (FED) matters regarding your retirement plans. Well, the FED’s actions have a significant impact on the economy, which, in turn, affects your retirement savings and plans in several ways:

- Improved Investment Returns: Affluent retirees often have a significant portion of their portfolios invested in bonds and other fixed-income assets. When the FED buys bonds, it’s known as quantitative easing. This increases their demand, which can drive up their prices and reduce yields. This can help lead to capital gains, potentially increasing the overall return on their investment portfolios.

- Lower Borrowing Costs: Retirees may have complex financial needs and access to various credit facilities. When the FED takes steps to make borrowing more affordable by injecting money into the financial system, it can help lower interest rates on loans, including mortgages and lines of credit. This can help wealthy retirees finance large purchases or investments at a reduced cost.

- Wealth Preservation: By managing the money supply and striving to maintain economic stability, the FED contributes to the overall health of the financial markets. This can benefit retirees by helping to preserve the value of their assets and investments, reducing the risk of significant market downturns that could erode their wealth.

- Income Opportunities: When the FED lowers interest rates, it can encourage lending and create income-generating opportunities for wealthy retirees. They may choose to invest in assets that offer higher yields or explore alternative investments that become more attractive in a low-rate environment.

So, even if you’re not directly involved in financial markets or banking, the FED’s actions can have far-reaching consequences that affect your retirement savings, income, and overall financial security. It’s essential to stay informed about these factors and consider seeking the help of a Fiduciary to help you make informed decisions for your retirement future.

How a Fiduciary Can Help

Navigating the complexities of retirement planning in the face of FED rate fluctuations can be challenging. A Fiduciary can play a crucial role in helping you make informed decisions. Here’s how a Fiduciary can assist you in managing FED rate-related challenges:

- Customized Investment Strategies: A Fiduciary will assess your unique financial situation and retirement goals. They can help you develop investment strategies that align with your objectives while considering the impact of changing interest rates.

- Risk Management: Fiduciaries can help you assess and manage the risks associated with FED rate fluctuations. They can recommend diversified portfolios that withstand market volatility and potential interest rate changes.

- Informed Decision-Making: By staying up-to-date on new FED policies, Fiduciaries can provide information to help you make informed decisions.

- Longevity Planning: Retirement planning is a long-term endeavor. A Fiduciary can help you create a comprehensive retirement plan that determines your financial goals and potential FED rate changes.

At Johnson Wealth and Income Management, our team of Fiduciaries has a comprehensive understanding of financial markets, which is instrumental in helping to combat the erosive effects of inflation. Our goal is to be your partner on your path to achieving a stable, prosperous, and stress-free retirement.

Final Thoughts

In the ever-changing landscape of financial markets and economic conditions, the Federal Reserve’s changes can present challenges for retirement planning. However, with the guidance of a dedicated advisor, you can confidently work towards securing your retirement goals.

Our experienced team is here to offer you the personalized advice you need to make informed decisions, help protect your financial future, and help you enjoy the retirement you’ve always envisioned. Your financial peace of mind is just a call or email away—Contact us today to get started.

All written content on this site is for informational purposes only. Opinions expressed herein are solely those of Johnson Wealth & Income Management and our editorial staff. Material presented is believed to be from reliable sources; however, we make no representations as to its accuracy or completeness. Investing involves risk. There is always the potential of losing money when you invest in securities. Asset allocation, diversification and rebalancing do not ensure a profit or help protect against loss in declining markets. All information and ideas should be discussed in detail with your individual advisor prior to implementation. The presence of this website, and the material contained within, shall in no way be construed or interpreted as a solicitation or recommendation for the purchase or sale of any security or investment strategy. In addition, the presence of this website should not be interpreted as a solicitation for Investment Advisory Services to any residents of states where otherwise legally permitted to conduct business. Fee-based financial planning and Investment Advisory Services are offered by Sound Income Strategies, LLC, an SEC Registered Investment Advisory firm. Johnson Wealth & Income Management and Sound Income Strategies LLC are not associated entities. Johnson Wealth & Income Management is a franchisee of the Retirement Income Source. The Retirement Income Source and Sound Income Strategies LLC are associated entities. © 2023 Sound Income Strategies.