You’ve diligently saved and invested in securing a comfortable retirement fund, but one often underestimated factor can throw a wrench into your well-laid plans: inflation.

The erosion of purchasing power due to inflation can significantly impact your retirement lifestyle and financial security. In this blog, we will explore how to help curb inflation in retirement. Here’s what you need to know.

Understanding Inflation

Inflation is the gradual increase in the general price level of goods and services over time. Your money’s purchasing power decreases as goods and services rise. While the U.S. Federal Reserve aims to maintain a target inflation rate of around 2%, inflation can fluctuate over the years, impacting your retirement savings differently.

In 2022, inflation was a big concern as it shot up to 9.1%, the highest in a long time. This sudden increase had a big impact on everyone, especially retirees. But things have changed since then, and inflation rates have been slowly decreasing, which is good news for investors.

Today, the U.S. inflation rate is at 3.67%. It’s slightly higher than last month (3.18%) but much lower than last year (8.26%). It’s essential to remember that even when inflation is not very high, it still can affect your finances. Let’s look at what these numbers mean for your retirement savings.

The Impact of Inflation on Retirement

When saving for retirement, it’s crucial to consider how your money’s value will change over time. Unfortunately, inflation can have a significant impact on your purchasing power. It’s important to note that some expenses, such as rising healthcare costs, will likely be higher than other goods and services. Let’s look at how inflation can affect your retirement.

- Food and Housing Costs: Inflation can significantly affect essential expenses like groceries and housing. Rising food prices and housing costs can strain your retirement budget, making it essential to plan for these increases.

- Investment Impact: Inflation can erode the real return on investments. If your investments don’t outpace inflation, generating enough income to sustain your retirement lifestyle may be challenging. Data shows that 1 in 4 Americans have had to pull back on retirement savings because of persistent inflation. This could have long-term repercussions, delaying their financial goals in the future.

- Social Security Benefits: While Social Security provides valuable income in retirement, the annual cost-of-living adjustment (COLA) may not always keep pace with inflation. The latest COLA is 8.7% for Social Security benefits and SSI payments. This can result in a gradual reduction in the real value of your Social Security income over time.

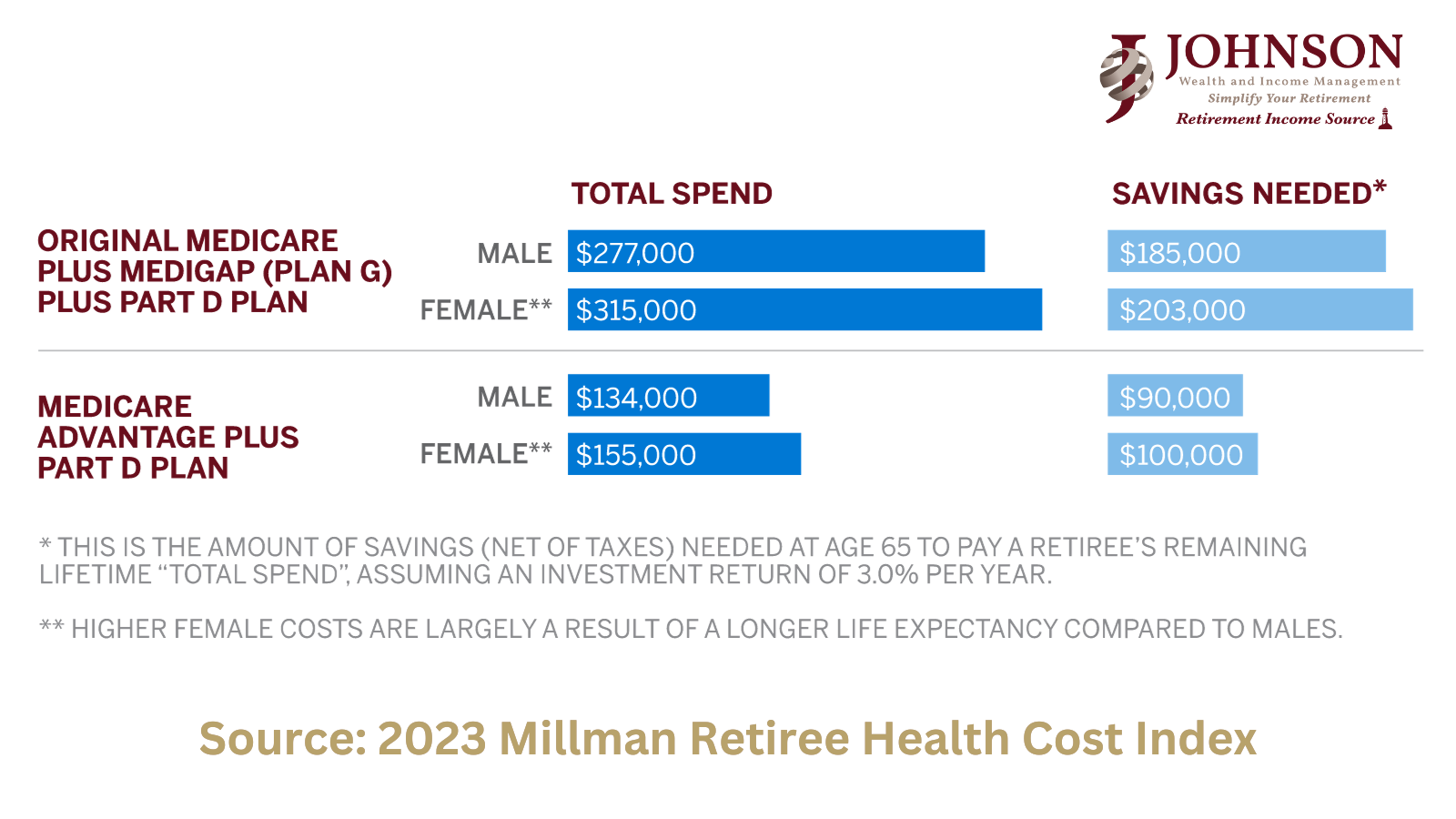

- Rising Healthcare Costs: An average 65-year-old retiring in 2023 is projected to spend a substantial amount for healthcare throughout their remaining lifetime. The photo below shows the expected cost for both a male and female retiree under the two most common coverage options. These rising healthcare costs can strain retirement budgets substantially, potentially diminishing the overall quality of life during one’s retirement.

Strategies to Help Curb Inflation

Inflation may be an economic force that erodes your purchasing power, but there are effective strategies to help you protect your savings and secure your financial future. Let’s delve into some of these tactics:

- Diversified Investments: Building a diversified investment portfolio is a key strategy to counter the impact of inflation. A diversified portfolio typically includes a mix of assets like stocks, bonds, real estate, and even inflation-protected securities such as Treasury Inflation-Protected Securities (TIPS). Stocks, in particular, have historically outperformed inflation over the long term, helping your investments grow even when prices rise. By diversifying your investments, you spread risk and enhance your chances of maintaining or increasing your purchasing power.

- Budgeting and Planning: Creating a budget and financial plan that factors in rising costs and anticipates future inflation is essential for retirees. A well-structured financial plan can help you stay in control of your finances and adapt to changing economic conditions. Consider consulting with a financial advisor to develop a comprehensive plan that aligns with your retirement goals and includes strategies to mitigate inflation’s impact.

- Savings Vehicles like Certificates of Deposit (CDs): Certificates of Deposit (CDs) can be useful to keep your money safe while still earning interest. These financial products allow you to deposit a fixed sum of money for a predetermined period, during which you earn a fixed interest rate. While the interest rates on CDs may not always outpace inflation, they offer stability and security for a portion of your savings. Be sure to explore the various CD options available, including those with longer terms that may provide higher yields.

It’s essential to stay informed, adapt your financial strategy as needed, and work with financial professionals who can provide guidance tailored to your specific circumstances and goals.

How a Fiduciary Advisor Can Help

A Fiduciary Advisor can be a crucial partner in your retirement planning, especially when dealing with the impact of inflation. They have a legal duty to prioritize your best interests, making your financial well-being their top priority. When crafting your retirement plan, a Fiduciary Advisor considers the potential impact of inflation and integrates strategies to counter it effectively.

At Johnson Wealth and Income Management, our team of Fiduciaries has a comprehensive understanding of financial markets, which is instrumental in helping to combat the erosive effects of inflation. Our Fiduciaries can help set realistic retirement goals to help you plan a sound strategy. We take pride in being able to provide our clients with a wealth of information, here are just some of the valuable resources we have available:

- Financial Blogs

- Capitalized Life & Retirement Podcast

- Capitalized Life YouTube Show

- Financial Calculators

- Retirement Reports

Moreover, we can help you navigate complex matters such as estate planning, helping to ensure a seamless transfer of your assets to your heirs. Our goal is to be your partner on your path to achieving a stable, prosperous, and stress-free retirement.

Final Thoughts

Incorporating inflation management into your retirement planning can be challenging, but you don’t have to go it alone. A Fiduciary Advisor like Matthew P. Johnson of Johnson Wealth and Income Management can assist you in creating a retirement plan that includes strategies to help minimize inflation’s impact on your savings.

Ready to help inflation-proof your retirement plan? Contact us today to get started.

All written content on this site is for informational purposes only. Opinions expressed herein are solely those of Johnson Wealth & Income Management and our editorial staff. Material presented is believed to be from reliable sources; however, we make no representations as to its accuracy or completeness. Investing involves risk. There is always the potential of losing money when you invest in securities. Asset allocation, diversification and rebalancing do not ensure a profit or help protect against loss in declining markets. All information and ideas should be discussed in detail with your individual advisor prior to implementation. The presence of this website, and the material contained within, shall in no way be construed or interpreted as a solicitation or recommendation for the purchase or sale of any security or investment strategy. In addition, the presence of this website should not be interpreted as a solicitation for Investment Advisory Services to any residents of states where otherwise legally permitted to conduct business. Fee-based financial planning and Investment Advisory Services are offered by Sound Income Strategies, LLC, an SEC Registered Investment Advisory firm. Johnson Wealth & Income Management and Sound Income Strategies LLC are not associated entities. Johnson Wealth & Income Management is a franchisee of the Retirement Income Source. The Retirement Income Source and Sound Income Strategies LLC are associated entities. © 2023 Sound Income Strategies.