If you’re approaching retirement, you may have questions about how this will affect your Medicare coverage. The new Inflation Reduction Act will bring some major changes to Medicare. Here’s what you should know.

People are living longer and retiring earlier. How do you account for health care costs in your retirement planning? If you’re like most people, you’re underestimating these expenses.

Although Medicare is a great thing for those retiring in the Midwest, it can pose a challenge to retirees who want to know what they’re covered for throughout their golden years. Here are some factors to consider to help ensure you and your wallet fall into retirement in excellent health.

Medicare 101

When it comes to Medicare, it’s important to know what the different letters mean. Medicare Part A covers hospital visits, Medicare Part B covers doctor’s visits, Medicare Part C is all-in-one coverage, and Medicare Part D is for prescriptions.

Medicare Part C includes hospital, doctor, and prescription coverage. This is sold through private insurers that contract with Medicare. A Medicare Advantage plan may also include dental and vision coverage.

You’re automatically enrolled in Medicare Parts A and B at the age of 65 if you’re already claiming Social Security. Or you’ll have the option to receive it when you get disability benefits from the Social Security Administration.

The New Inflation Reduction Act

First, here are some Medicare changes you might want to know about:

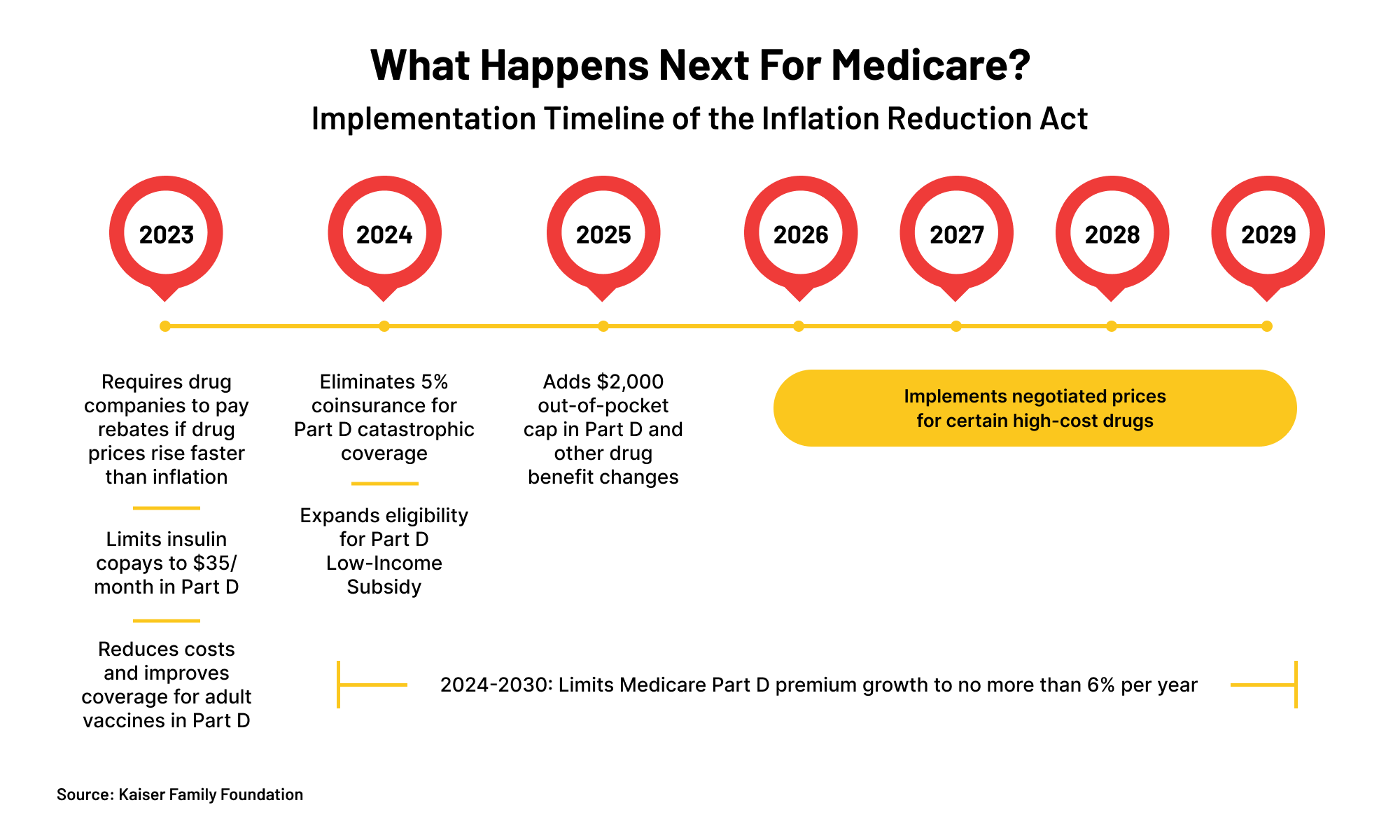

The climate, tax and health care bill known as the Inflation Reduction Act that was passed by Congress and signed into law by President Joe Biden last month includes significant improvements to the Medicare program that will kick in over the next few years. The key takeaways that are coming to Medicare Part D will be related to drug costs. The idea is that with the passing of this bill, Medicare will have more power to negotiate the prices of drugs. This means that those enrolled in Medicare’s health program may be able to get more affordable prices on their drugs. Beyond getting more leverage to negotiate, there will be other changes, too. Some of these changes include limits on drug costs, and caps on out-of-pocket spending, as well.

Be Mindful of Deadlines

Medicare is a complicated system, and it’s easy to find yourself falling behind if you don’t know what you’re doing. Fortunately, there are deadlines for Medicare that can help you avoid some of the most common problems.

Medicare open enrollment happens every fall from October 15 through December 7. This enrollment period is only for existing Medicare enrollees who want to make changes to their coverage. Any changes you make during the 2021 Medicare enrollment period will affect your 2022 Medicare plan, beginning Jan. 1, 2022. Note that the 2022 open enrollment period for health insurance was extended, but the dates for Medicare open enrollment were not extended.

If this is your first time signing up for Medicare, the first deadline is the Initial Enrollment Period (IEP). If you sign up during this time, you can help avoid a significant amount of hassle. This enrollment period starts three months before you turn 65 and extends until three months after. Failing to sign up on time may result in up to $6,500 more in premiums over 20 years. This occurs because you may be assessed a 10 percent penalty for each year that passes without enrollment.

Understand Your Benefits

Medicare is an essential source of healthcare for seniors and the disabled, who are often too young or infirm to work. Medicare provides coverage for hospital visits, doctor visits and prescriptions.

As you age, it’s important to know what Medicare covers and what it doesn’t. The following are some benefits that might surprise you:

- An annual wellness visit where your doctor will perform a physical and order any necessary screenings

- If you have difficulty traveling to appointments, you might take advantage of Medicare’s virtual consultations

- Medicare also offers nutritional counseling as part of your plan

Find The Right Doctor

If you’re switching insurance providers, it’s important to know that this may change the cost of your care. The way providers accept Medicare can vary widely, and some choose not to accept it at all.

If your doctor is a participating provider, they’ll accept Medicare’s fee as the entire covered portion, which means you’ll likely only be responsible for 20% of their services. If your doctor is a non-participating provider, they will accept Medicare as a form of payment but may charge you up to 15% more out of pocket.

You may also want to consider switching to a doctor who specializes in geriatrics so that they have more experience in issues that you may encounter as you age.

Factor in Medicare in your Retirement Plan

Every Iowan should factor Medicare in their retirement plan. According to the Society of Actuaries, healthcare expenses are expected to increase by an average of 5.2% every year. That means they will become a larger and larger portion of retirement spending over time.

What’s more, in 2021, the average retired couple age 65 needed approximately $300,000 saved (after tax) to cover healthcare expenses alone in retirement. And as of 2020, the average healthy 67-year-old retired couple spent 34% of their Social Security income on healthcare expenses. If you’re still in the workforce, one way to help prepare is to enroll in a health savings account (HSA), which some employers offer.

An HSA can help you save tax-efficiently for healthcare costs in retirement. You could help save pre-tax dollars (and possibly collect employer contributions), which have the potential to grow and be withdrawn tax-free for federal and state tax purposes if used for qualified medical expenses.

Finally, long-term care insurance provides services (such as nursing home care) that Medicare doesn’t cover. To qualify, you likely will need to apply for coverage while in good health. This is certainly something to look into if you’re planning for retirement or getting ready to retire.

Final Thoughts

Whether you’re retired or are planning to retire, a full-service Fiduciary advisor can help you better understand your Medicare options. At Johnson Wealth and Income Management, our goal is to help you plan for a more safe and secure retirement. We take the time to sit down with you and craft a plan that takes care of all of your needs for years to come; including planning for Medicare, long-term healthcare, new legislations such as the new Inflation Reduction Act and more.

Are you currently looking for a Fiduciary financial advisor in Iowa to help you navigate through retirement planning? You can trust that our advisors will always put your needs ahead of their own. It’s our legal obligation to you as Fiduciaries, but it’s also simply the right thing to do. Contact us here today to start the conversation.

All written content on this site is for informational purposes only. Opinions expressed herein are solely those of Johnson Wealth & Income Management and our editorial staff. Material presented is believed to be from reliable sources; however, we make no representations as to its accuracy or completeness. Investing involves risk. There is always the potential of losing money when you invest in securities. Asset allocation, diversification and rebalancing do not ensure a profit or help protect against loss in declining markets. All information and ideas should be discussed in detail with your individual advisor prior to implementation. The presence of this website, and the material contained within, shall in no way be construed or interpreted as a solicitation or recommendation for the purchase or sale of any security or investment strategy. In addition, the presence of this website should not be interpreted as a solicitation for Investment Advisory Services to any residents of states where otherwise legally permitted to conduct business. Fee-based financial planning and Investment Advisory Services are offered by Sound Income Strategies, LLC, an SEC Registered Investment Advisory firm. Johnson Wealth & Income Management and Sound Income Strategies LLC are not associated entities. Johnson Wealth & Income Management is a franchisee of the Retirement Income Store. The Retirement Income Store and Sound Income Strategies LLC are associated entities. © 2021 Sound Income Strategies.