When saving for your golden years, risks and opportunities present themselves in various forms, each with its own set of unique characteristics. Recognizing and effectively managing these elements during retirement is essential to help secure a financial future.

A substantial risk that looms over many retirees is the fear of running out of money. This uneasiness stems from insufficient savings because people live longer than in previous decades. A staggering 21% of U.S. adults openly admit that their most significant financial regret is not starting their retirement savings journey soon enough.

In this blog, we will delve into the fundamental aspects of retirement planning, equipping you with the knowledge and strategies needed to navigate the potential risks and opportunities accompanying this important life stage. Let’s explore what you need to know to make informed decisions about your retirement.

Understanding Risk

Retirement comes with risks that need careful attention. Financial risks come in different shapes and sizes, such as longevity and inflation. Risk management is best understood not as a series of steps but as a cyclical process in which new and ongoing risks are monitored. Risks provide a way to update and review investment planning strategies as new developments occur and then take steps to help protect your nest egg.

Retirement planning means finding the best way to help protect the life you’d like to live after you stop earning income from employment. Risk Management should be a part of every retirement income plan. Let’s look at some financial risks you will likely find when planning your retirement.

Identifying Risks

Retirement brings forth a host of monetary risks, with the fear of running out of money at the forefront. Longer life expectancies and insufficient savings create this precarious situation. Let’s delve into retirees’ key financial risks and explore strategies to manage them effectively.

- Market Volatility: One of the most significant financial risks in retirement is the unpredictability of financial markets. Your retirement savings are likely invested in various assets, and market fluctuations can impact your portfolio’s value. To mitigate this risk, consider diversifying your investments and adjusting your asset allocation as you approach retirement to help reduce exposure to market volatility.

- Longevity Risk: With increasing life expectancy, the risk of outliving your savings (longevity risk) is a genuine concern. To address this, you can purchase annuities that help provide a guaranteed income stream for life or create a sustainable withdrawal strategy that factors in your lifestyle and financial needs. But remember, certain annuities come with higher risks than others, so be sure to speak with your financial advisor before exploring annuity options to see if they are right for you.

- Inflation: Inflation erodes the purchasing power of your money over time. To help combat this risk, invest in assets that have the potential to outpace inflation, such as stocks and real estate. Additionally, consider inflation-adjusted retirement income sources like Social Security.

Healthcare Risks

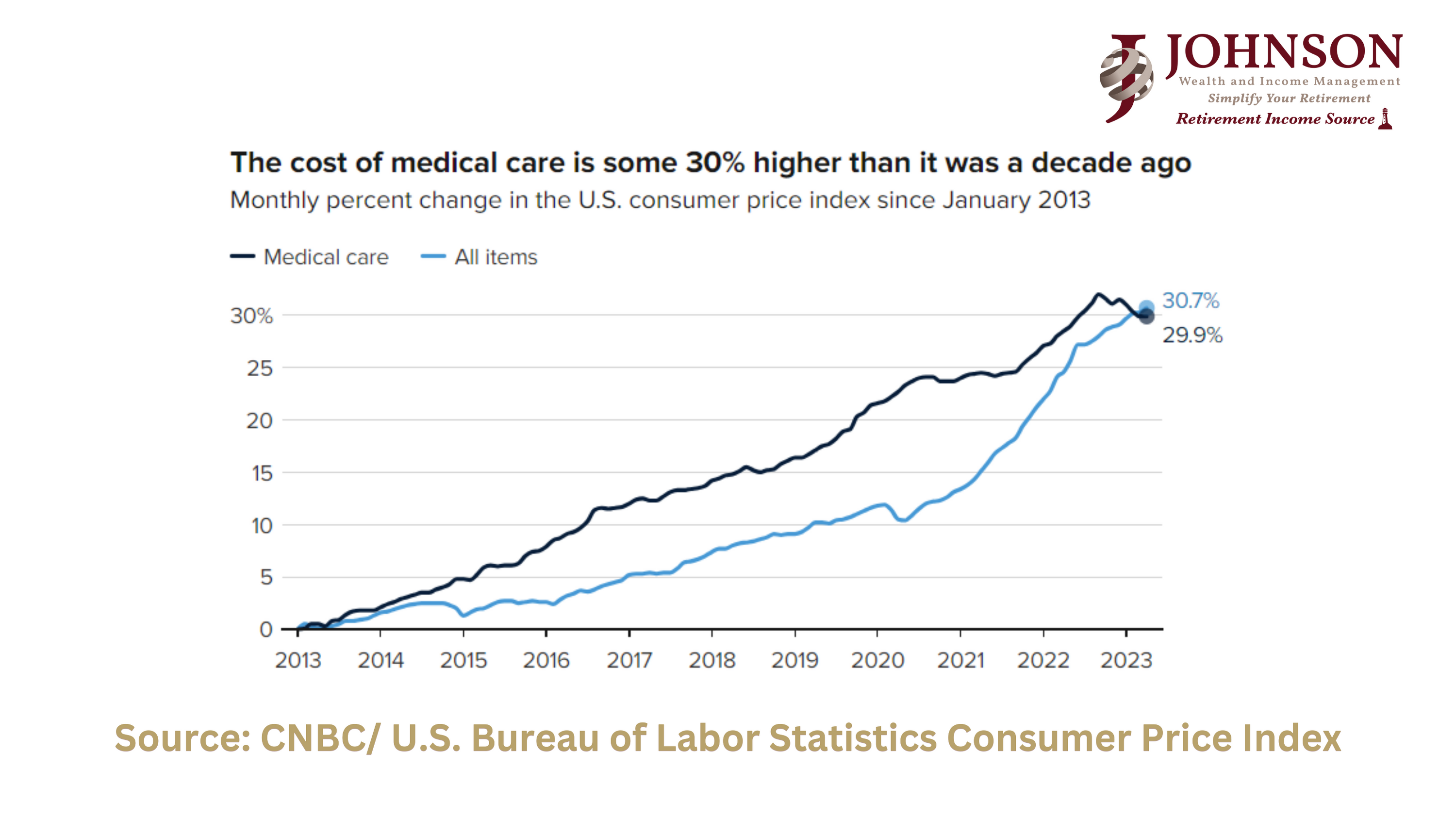

As we age, the certainty of increased medical expenses becomes a pressing concern. Despite a recent decline in the cost of medical care, data from the U.S. Bureau of Labor Statistics reveals that it remains nearly 30% higher than a decade ago.

Furthermore, a survey conducted by the Federal Reserve found that 30% of retirees cited health problems as a factor influencing their decision on when to retire. Addressing this type of risk is crucial. Begin by exploring other forms of supplemental healthcare insurance to allocate funds for unexpected medical emergencies.

In addition to healthcare costs, the need for long-term care, which includes services like nursing homes or home healthcare, represents a substantial risk. It is advisable to consider long-term care insurance or establish a dedicated fund to cover potential expenses to address this risk.

Estate Planning Risks

While retirement should be a relaxation time, it can, unfortunately, bring emotional challenges, such as loss, boredom, or isolation. The passing of a spouse, in particular, can be emotionally devastating and potentially impact your financial stability significantly. Estate planning can be a vital tool in preparing for this inevitable eventuality.

Estate planning goes beyond the financial aspects and encompasses a comprehensive strategy to help protect your legacy and fulfill your wishes. It involves creating legal documents such as wills and trusts, designating beneficiaries, and making decisions about asset distribution. This process helps provide financial security for your loved ones and helps mitigate the potential financial risks of losing a spouse, or leaving your family to cope with the financial effects of your own passing.

Moreover, estate planning allows you to consider the distribution of assets, management of debts, and the guardianship of dependents. Working alongside a financial advisor can help you create a structured framework to address these critical matters so that you can be prepared when a challenging time arises.

Opportunities in Retirement

It’s not all doom and gloom. Retirement unfolds a world of wonderful possibilities, beckoning you to seize new experiences and enrich your life in various ways:

- Travel and Leisure: Retirement liberates you to embark on adventures, discover uncharted destinations, and indulge in hobbies and leisure activities that once took a back seat to work demands.

- Lifelong Learning: The retirement years offer a splendid chance to embark on a journey of continuous discovery. Whether mastering a new language, learning to play a musical instrument, or diving into a subject you’re deeply passionate about, ongoing learning keeps your mind active and engaged.

- Charitable Giving: Many retirees discover a deep sense of purpose by contributing to their communities through volunteering or charitable giving. Utilizing charitable giving tax strategies during retirement is key for helping to protect your retirement. It’s also an opportunity to share your skills, wisdom, and experiences while positively impacting those around you.

Choosing the Right Financial Advisor

Retirement planning is not a one-time event; it’s an ongoing process. Your financial advisor should be pivotal in keeping you on the right track as your life circumstances and financial objectives evolve.

Working with a dependable advisor can help offer peace of mind along with helping you make financially wise choices. Utilizing the experience of our Fiduciary advisors can help provide the following:

- Regularly reviewing your investment portfolio and ongoing performance evaluation.

- Assessing whether your investments align with your financial goals to help ensure your portfolio maintains its intended asset distribution through timely adjustments.

Working with Fiduciary advisors like the Johnson Wealth and Income Management team can help provide valuable guidance and support around your investment and asset preservation strategies. We aim to provide unbiased advice in harmony with your financial goals and needs, providing impartial advice whenever you need it most.

Understanding risks and opportunities for retirement is key. Our Iowa-based team can thoroughly assess your financial situation, identify potential risks, and help you create a personalized plan tailored to your unique needs.

If you’re ready to find an advisor who will build a long-lasting partnership for decades, our advisors are here to answer your questions.

Contact us today to schedule your complimentary retirement strategy session.

All written content on this site is for informational purposes only. Opinions expressed herein are solely those of Johnson Wealth & Income Management and our editorial staff. Material presented is believed to be from reliable sources; however, we make no representations as to its accuracy or completeness. Investing involves risk. There is always the potential of losing money when you invest in securities. Asset allocation, diversification and rebalancing do not ensure a profit or help protect against loss in declining markets. All information and ideas should be discussed in detail with your individual advisor prior to implementation. The presence of this website, and the material contained within, shall in no way be construed or interpreted as a solicitation or recommendation for the purchase or sale of any security or investment strategy. In addition, the presence of this website should not be interpreted as a solicitation for Investment Advisory Services to any residents of states where otherwise legally permitted to conduct business. Fee-based financial planning and Investment Advisory Services are offered by Sound Income Strategies, LLC, an SEC Registered Investment Advisory firm. Johnson Wealth & Income Management and Sound Income Strategies LLC are not associated entities. Johnson Wealth & Income Management is a franchisee of the Retirement Income Source. The Retirement Income Source and Sound Income Strategies LLC are associated entities. © 2023 Sound Income Strategies.